Certificate Services:

Weekly Market Update.

At Ecovantage, we consistently analyse market activity, creation metrics, policy changes, and consultation releases in conjunction with wider landscape activity.

Sign up below to receive Market Updates and spot prices delivered to your inbox every Friday.

Weekly Market Update | 24 January 2025

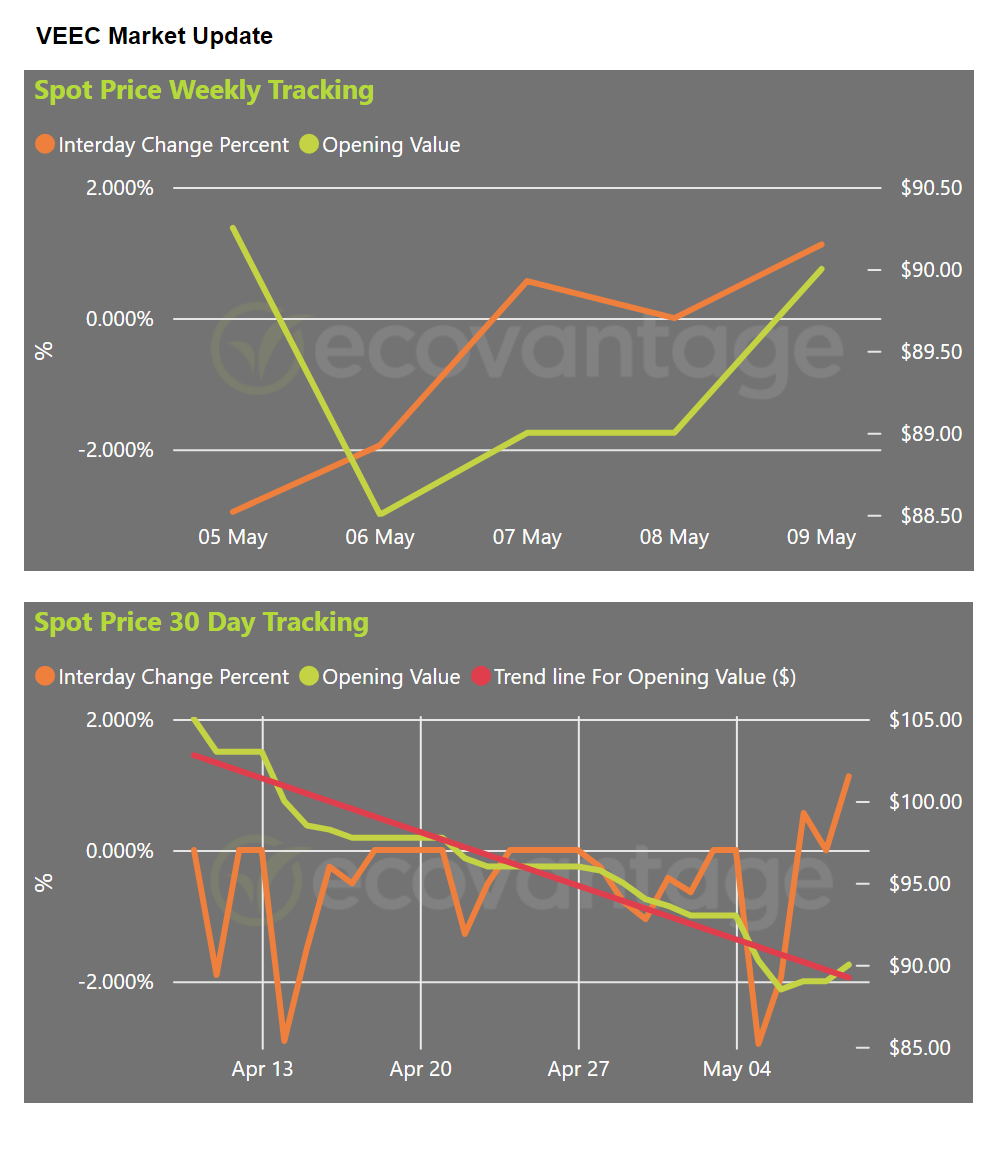

VEEC: VEEC creation levels have decreased by 3% from last week, at 126,272 VEECs created this week. VEEC spot market prices saw a marginal decrease this week. While Monday saw no reported trades, activity picked up from Tuesday onwards. Prices hovered around the $108.25 mark, with a slight upward nudge mid-week to $108.50 before settling back down to $108.00 by the end of the week. Trading volumes varied, with larger transactions occurring towards the end of the week.

The VEEC forward market showed a generally softening trend over the week. Tuesday saw October and November 2025 contracts at $107.50, March 2025 at $108.10, and the July-October strip at $107.50. By Wednesday, strip prices had dipped to $107.00 for both the September 2025 -March 2026 and July 2025 -October 2026 periods. Thursday’s August 2025 -December 2025 strip traded slightly higher at $107.10. Friday saw further downward pressure, with the January-March 2026 strip falling to $106.90 and then $106.85, while the May-June strip held at $107.10, and July 2025 traded at $106.75.

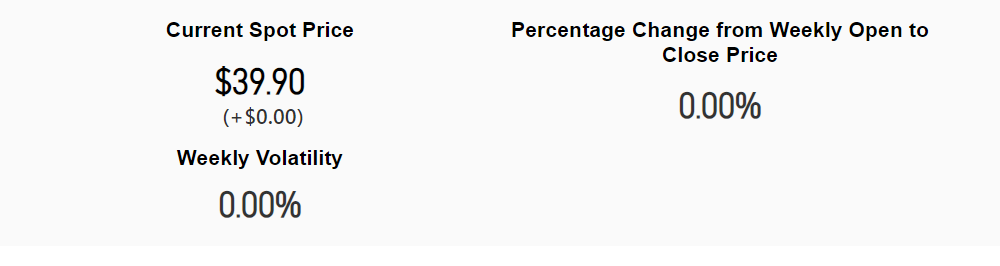

STC: The clearing house has continued a deficit, which increased to 2.68 million STCs as the current surrender period closure approaches on 15 February. Prices remained at high of $39.90 with no trades reported for the week.

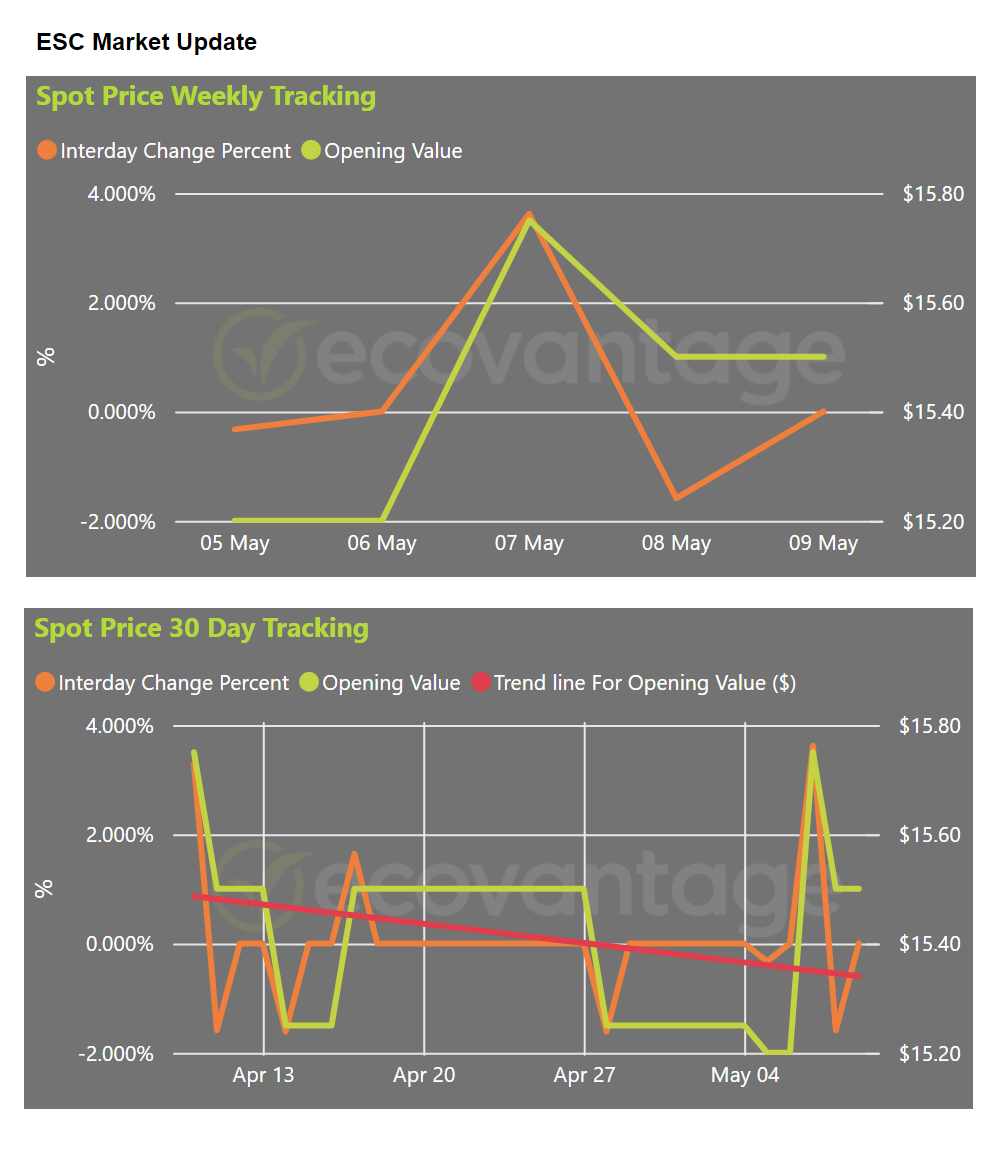

ESC: The ESC market saw a 50% increase in creation from last week’s numbers sitting at 81,671 ESCs created.

ESC spot market saw a series of single trades at a stable rate of $14.00 at 25k, 28k and 10k for the first three days of the week, before closing the week the last trade is reported at $13.85 with a 60k trade on Thursday. While there were no trades reported on the forward market, one trade went through the option market for September 2025 as a Call Option @$0.72 for 25k at $16.00.

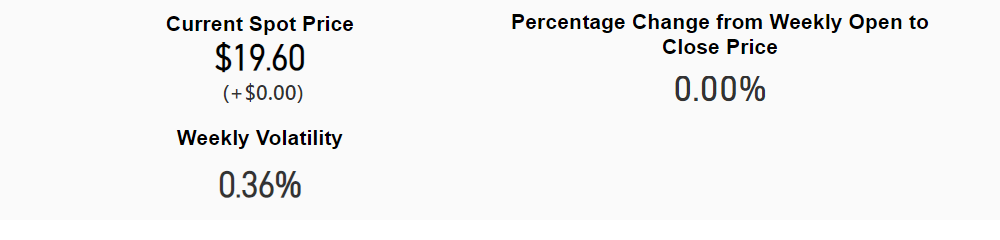

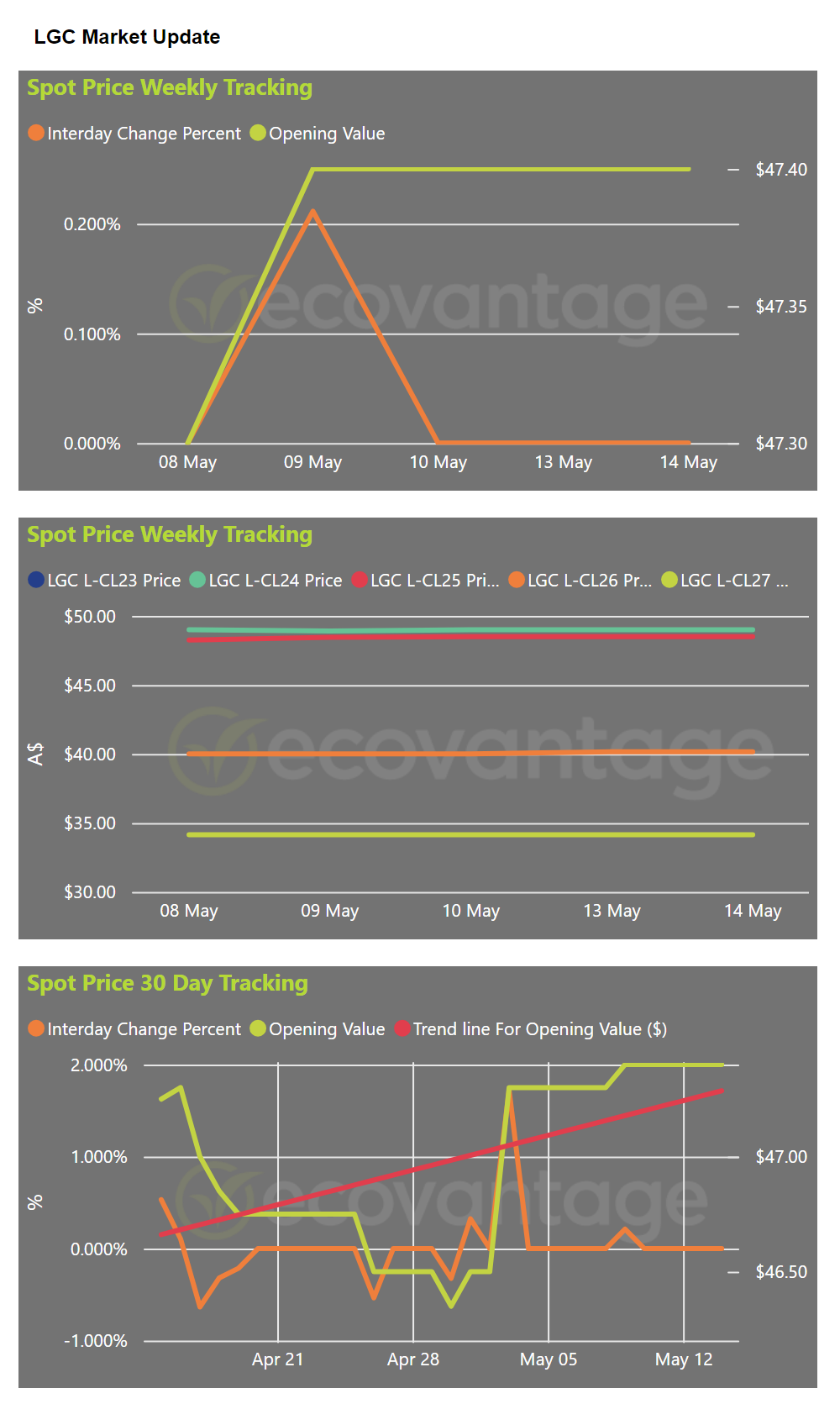

LGC: The LGC spot market experienced price volatility and a general downward trend leading up to the February 14th surrender deadline.

Monday saw trading at $29.50 with a 10k trade, with prices peaking at $30.25 on Tuesday before closing at $30.15 in 15k. Wednesday’s activity was concentrated around $29.50-$29.75 in 45k total. Thursday held steady at $29.50 with a 10k trade, but Friday saw a significant drop, opening at $29.00 with a 50k trade and closing at $28.25 in 25k.

CAL24 Vintages opened the week strong at $32.75 before declining to $29.75 by close of business. Prices picked back up the next day at $30.25 before settling to $30.15 by the end of the day. No further trades were reported.

The forward market saw activities throughout the week with most activities occurring at the start and at the end of the week. CAL25 contracts were active throughout the week, starting strong around $30.00-$30.25 on Monday and Tuesday, then fluctuating but generally holding above $30.00 until Thursday. Friday, however, saw a significant drop, with trades ranging from $30.00 down to $28.00. CAL26 contracts also showed a weakening trend, starting around $24.00-$24.75 and declining steadily to the $22.50-$23.75 range by Friday. Both CAL27 and CAL28 saw limited trading with one trade reported on Monday. CAL27 traded at $19.00 for 86k and $18.75 for 20k trades. And CAL28 at $16.00 with a 25k trade.

One option trade went through this week for a $2.19 call spread trade for 50k CAL26 LGC between $25.00-$35.00.

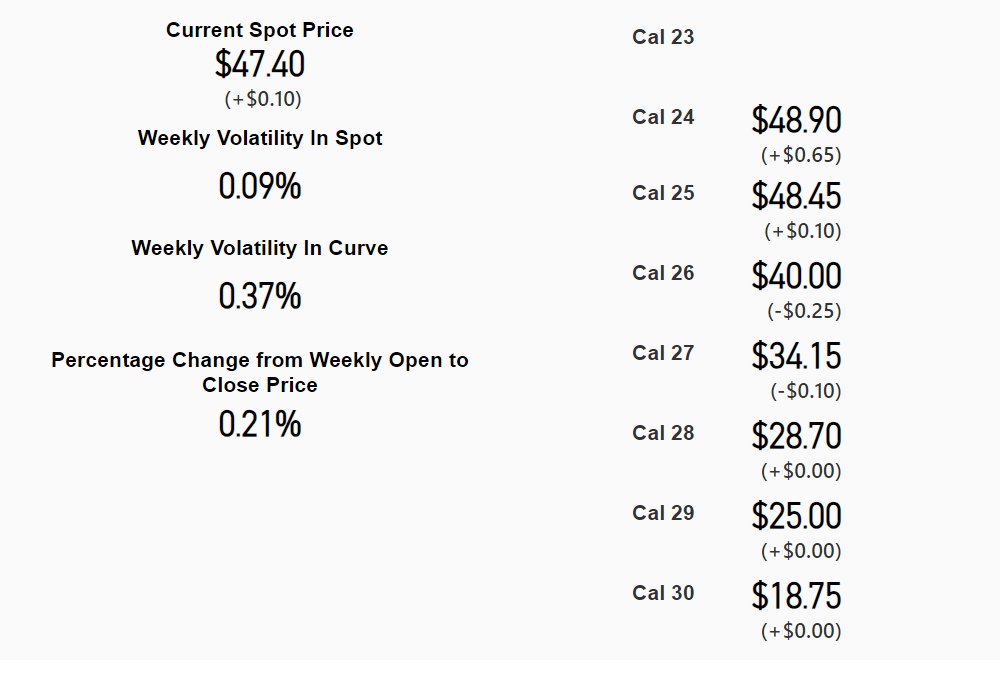

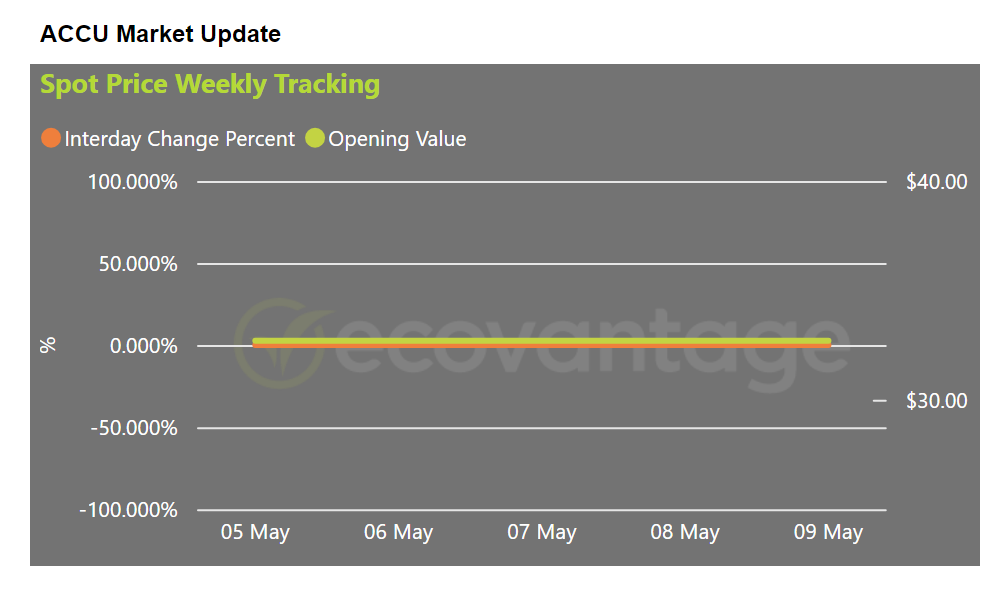

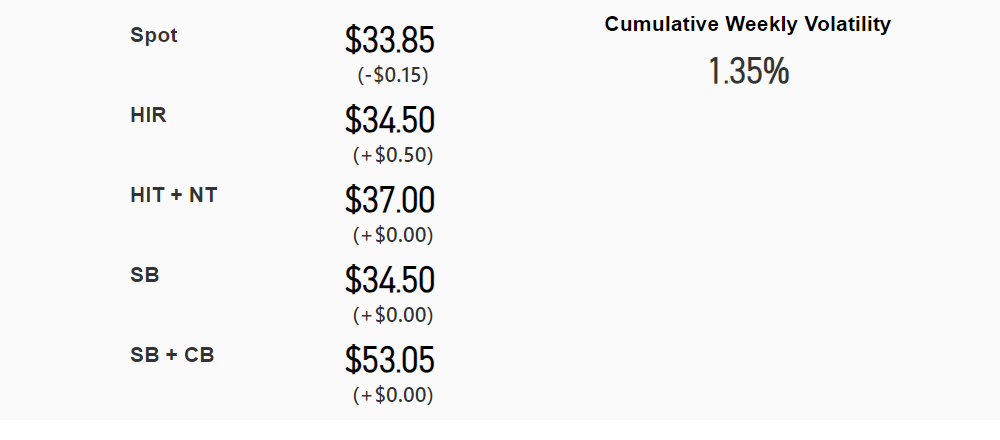

ACCU: ACCU (HIR) spot prices fluctuated slightly over the week. Tuesday saw trades ranging from $33.75 to $34.50, with moderate volume. Wednesday’s activity was limited but showed prices around $33.75-$33.90. Thursday saw no reported trades. Friday showed a slight rebound, with prices settling around $34.10-$34.25. Overall, the ACCU spot market activity suggests relatively minor price movements and moderate trading activity.

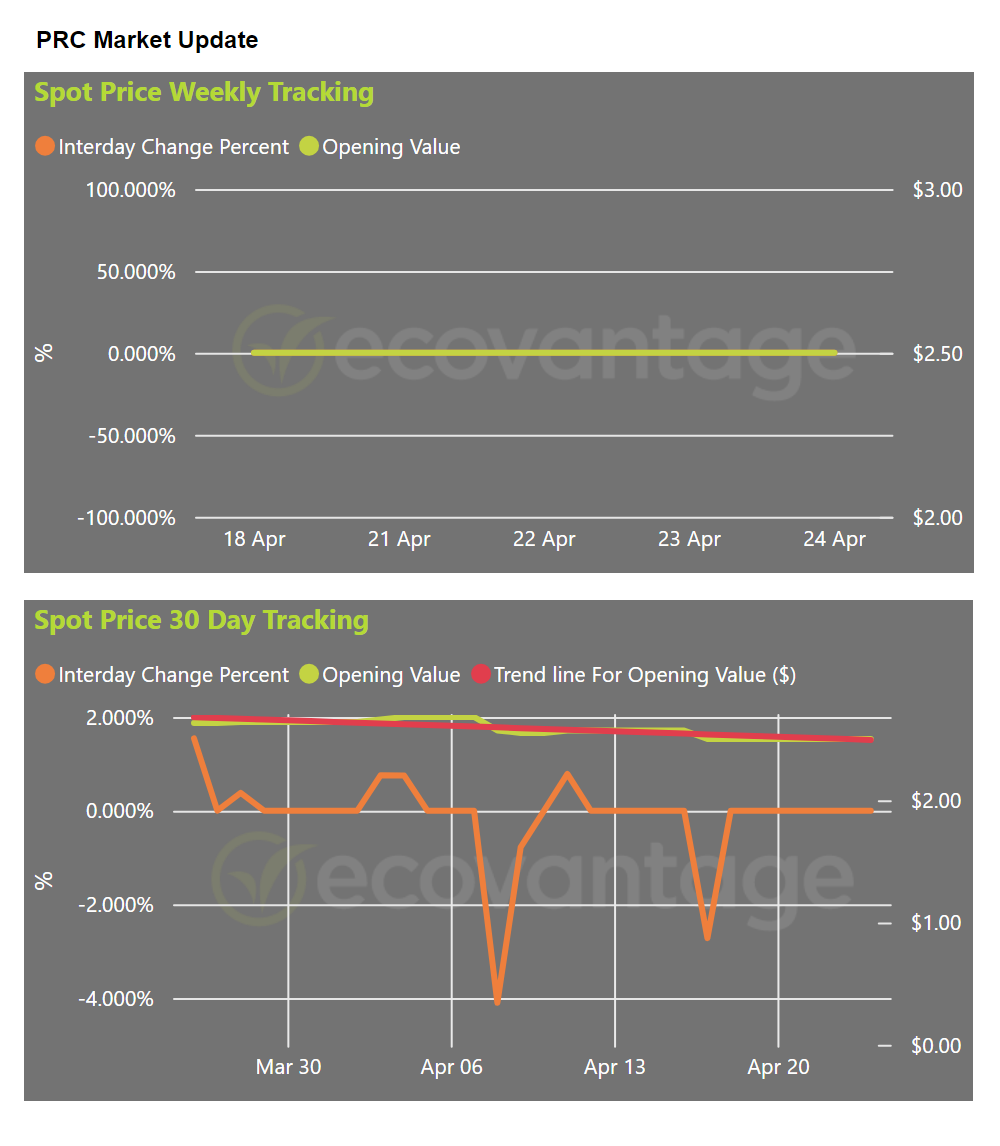

PRC: PRC creation levels show a 40% decrease this week from the last at 628,207 PRCs created. The most notable growth this week came from BESS activity making up 37% of the overall numbers this week with 234,153 PRCs created.

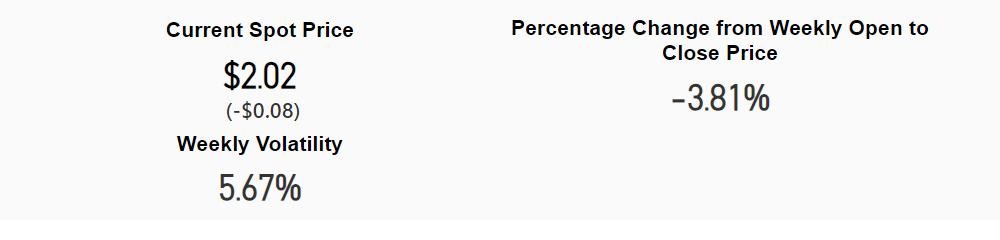

This week the both PRC spot and forward market remained quiet with no trades reported, as prices remained stable at $2.58.

See below for pricing updates for each certificate.

As Australia’s most versitile Accredited Certificate Provider (ACP), Ecovantage maintains strong market analytics to keep our partners and clients on top of the certificate market. Below is the current spot price tracking and price charts across the federal and state energy certificates.

Pricing and summary is accurate as of the time of publishing. Pricing and charts are automatically generated daily.

Ecovantage is not liable for any errors or changes in the figures provided.

Victorian Energy Upgrades Program.

Victorian Energy Efficiency Certificates (VEECs)

Victorian Energy Upgrades Program (VEU)

Victorian Energy Efficiency Certificates (VEECs) are credits issued under the Victorian Energy Energy Efficiency Target (VEET) scheme for eligible energy upgrades, from large commercial and industrial sites down to individual homes. The quantity of VEECs issued is based on the amount of calculated greenhouse gas emissions avoided through the upgrade.

Learn More About VEECsFederal Renewable Energy Target.

Small-Scale Technology Certificates (STCs)

Federal Renewable Energy Target (RET)

Small-scale Technology Certificates (STCs) are a tradeable certificate in Australia’s renewable energy market. They are part of the federal government’s Renewable Energy Target (RET) scheme, which aims to promote the uptake of renewable energy sources.

1 STC = 1 MWh of calculated electricity either generated by a renewable energy source or displaced by the installed system.

The quantity of STCs is calculated based on the location of the system, the electricity generated or displaced, and the years left in the scheme until it ends in 2030.

Learn More About STCsNSW Energy Savings Scheme.

Energy Savings Certificates (ESCs).

NSW Energy Savings Scheme (ESS)

Energy Savings Certificates (ESCs) are a tradable certificate issued for electricity, gas, and other energy savings that result from a technology upgrade or modification.

ESCs are created under the New South Wales Government’s Energy Savings Scheme (ESS) and are available only to projects within the state. ESCs are used as a market-based mechanism to increase the implementation of energy efficiency measures, and are able to be created for projects within large industrial sites down, all the way down to residential properties.

Learn More About ESCsFederal Renewable Energy Target.

Large-Scale Generation Certificates (LGCs)

Federal Renewable Energy Target (RET)

Large-Scale Generation Certificates (LGCs) are created to quantify renewable energy that has been generated through solar, wind, hydro, and biomass projects. This is done under the Renewable Energy Target, known as the RET.

Each LGC represents one megawatt hour of renewable energy, and one LGC may be created for each MWh of actual energy generated by the project.

These LGCs act like a stock that can be traded to gain a financial benefit, or surrendered to claim the renewable energy benefit.

Learn More About LGCsFederal Emissions Reduction Fund.

Australian Carbon Credit Units (ACCUs)

EE (Energy Efficiency) | HIR (Human Induced Regeneration) | NT (Native Title) | SB (Savanna Burning) | CB (Co-Benefits) | ICB (Indigenous Co-Benefits)

Federal Emissions Reduction Fund (ERF)

Australian Carbon Credit Units (ACCUs) are an Australian based carbon credit that can be created as a result of activities that avoid or remove greenhouse gas emissions.

Each ACCU is representative of one tonne of carbon dioxide having been removed, or avoided, by the eligible activity.

Learn More About ACCUsPeak Demand Reduction Scheme.

Peak Reduction Certificates (PRCs)

Peak Demand Reduction Scheme (PDRS)

Peak Reduction Certificates (PRCs) are tradable certificates under the NSW Government’s Peak Demand Reduction Scheme (PDRS).

1 PRC represents 0.1 kilowatts of peak demand reduction capacity averaged over one hour during the peak summer period.

This aims to encourage peak energy use reduction within peak demand times, to reduce pressure on the electricity grid and in turn reduce energy prices.

Learn More About PRCsReceive weekly market updates and up-to-date spot prices delivered to your inbox every Friday.

What Organisations do with Certificates.

Once generated through an eligible energy saving project, certificates are sold or traded to liable entities, such as energy retailers.

Sold certificates are generally used to reduce the upfront investment cost of an energy efficiency project.

Don’t want to watch? Read the transcript here.

Australia’s Most Versatile ACP.

Ecovantage specialises in creating, trading, and supplying all energy certificates, including VEECs. We assist you in balancing the financial and environmental scales for each project.

Ecovantage provides an end-to-end service, from site audits and project management, through to generation and monetisation of the created certificates.

The treatment of certificates is based on the financial and carbon goals of each organisation. The options available are presented with their relevant outcomes on both fronts, to ensure your decision is an informed one. Ecovantage generates and trades certificates as an authorised provider through the Independent Pricing and Regulatory Tribunal (IPART).

Australian Certificate Attributes and Recognition

| Certificate | Classification | Representative Of | Attribute Recognised by External Programs? | Purpose |

| ACCU | Carbon Credit | 1 Tonne of CO2-e | Carbon | Recognise and Measure Carbon Abatement |

| LGC | Renewable Energy Certificate | 1 MWh of Renewable Generation | Renewable Energy | Recognise and Measure Renewable Generation |

| STC | White Certificate | 1 Calculated MWh of Renewable Generation | None | Create a Financial Incentive for Small-Scale Renewable Generation |

| VEEC | White Certificate | 1 Calculated Tonne of CO2-e | None | Create a Financial Incentive for Energy Efficiency Upgrades |

| ESC | White Certificate | 1 Nominal MWh | None | Create a Financial Incentive for Energy Efficiency Upgrades |

| PRC | White Certificate | 0.1kW of Peak Demand Reduced | None | Create a Financial Incentive for Peak Demand Reduction |

| REPS | White Certificate | 1 Calculated GJ | None | Create a Financial Incentive for Energy Efficiency Upgrades |

White certificates = STCs, ESCs, VEECs & REPs

| Program | ACCUs | LGCs | White Certificates |

| RE100 | |||

| Climate Active | |||

|

|

|||

| GreenPower | |||

| NABERS | |||

| Green Building Council of Australia | |||

| Greenhouse Gas Protocol |

Victoria

Victoria New South Wales

New South Wales South Australia

South Australia Queensland

Queensland